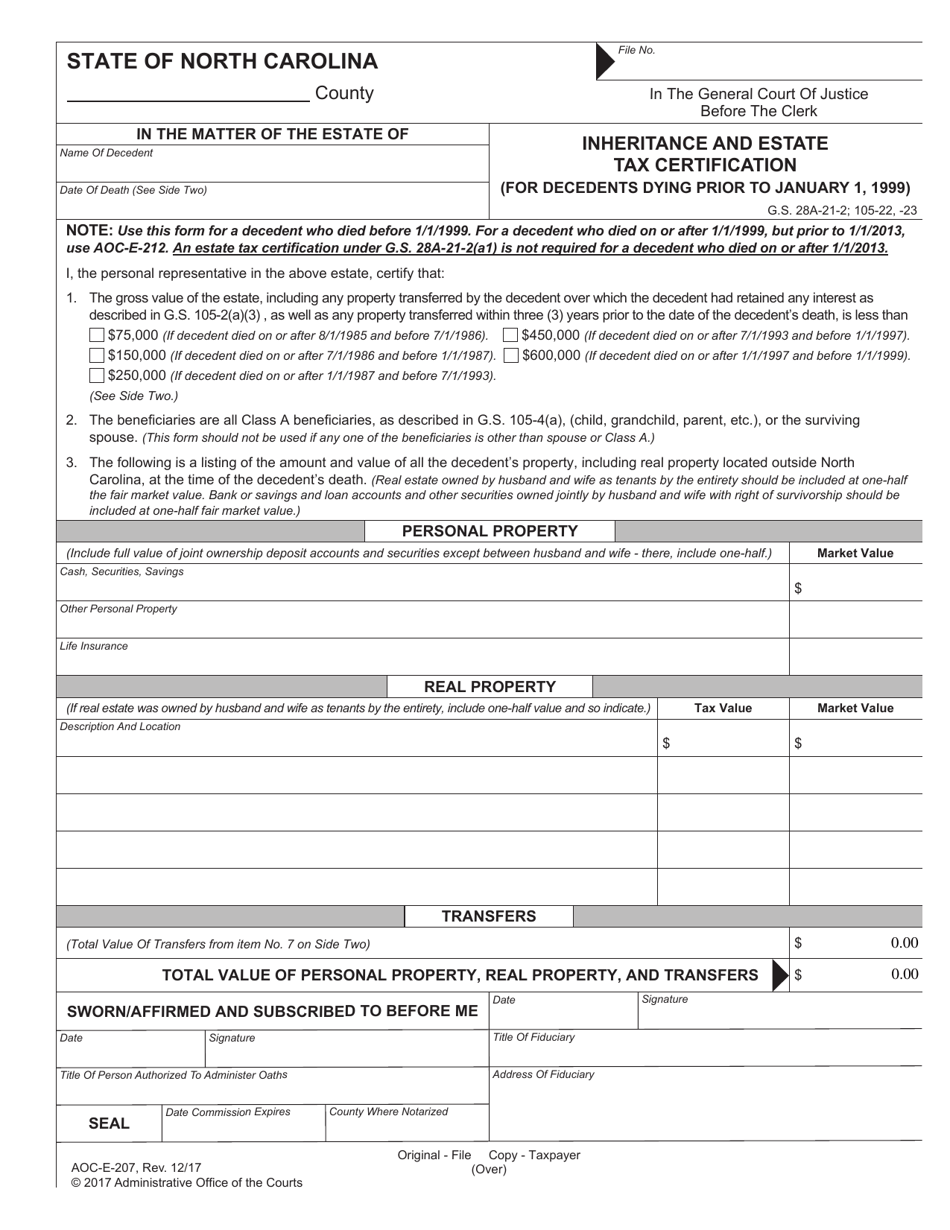

north carolina estate tax certification

Owner or Beneficiarys Share of NC. Instant access to fillable Microsoft Word or PDF forms.

Death And Taxes The Public Finance Blog You Can T Avoid

Find a courthouse Find my court date Pay my citation online Prepare for jury service.

. For a decedent who died. Real Estate Checklist Tax. Duty to Furnish a Certificate-On the.

IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. Estate Tax Certification For Decedents Dying On Or After 1 1 99. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291.

Beneficiarys Share of North Carolina Income Adjustments and Credits. For a decedent who died on or after 111999 but. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE.

NC K-1 Supplemental Schedule. Estate Tax Certification For Decedents Dying On Or After 1199. Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399.

North Carolina Judicial Branch Search Menu Search. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws. North Carolina law requires the Department of Revenue to provide a certification and continuing education program for county.

Use this form for a decedent who died before 111999. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. County Assessor and Appraiser Certifications.

Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. SUBSTANTIAL INVOLVEMENT IN ESTATE PLANNING LAW.

Estate Tax Certification For. County Assessor and Appraiser Certification Table NCDOR. Tax Certification Guidelines.

GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited. Minimum of 400 hours for any one year. For a decedent who died.

North Carolina Department of Revenue. PO Box 25000 Raleigh NC 27640-0640. Degree in taxation or estate.

Use this form for a decedent who died on or after 111999 but prior to 112013. Average of at least 500 hours a year. As of March 1 2019 the Davidson County Tax Department has implemented the Tax Certification requirements per North Carolina General Statute 161-31 and the resolution adopted by the.

Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of property by. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws. Receipt of an LLM.

Use this form for a decedent who died on or after 111999 but prior to 112013. Download Free Print-Only PDF OR Purchase Interactive PDF Version of this Form.

Form Aoc E 207 Download Fillable Pdf Or Fill Online Inheritance And Estate Tax Certification For Decedents Dying Prior To January 1 1999 North Carolina Templateroller

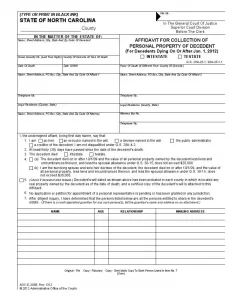

Free North Carolina Small Estate Affidavit Form Pdf Formspal

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms

Online Tax Services Guilford County Nc

How To Get Estate Tax Clearance On Your Home Cipparone Zaccaro

5 17 2 Federal Tax Liens Internal Revenue Service

Valuation Discounts For Gift And Estate Tax Savings Wealth

North Carolina Gift Tax All You Need To Know Smartasset

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms

Tax Rockingham County North Carolina

Tax Administration Duplin County Nc Duplin County Nc

How Long Does It Take To Probate A Will In Nc Teddy Meekins Talbert P L L C

Guilford County Tax Department Guilford County Nc

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Complete Guide To Probate In North Carolina

3 11 106 Estate And Gift Tax Returns Internal Revenue Service